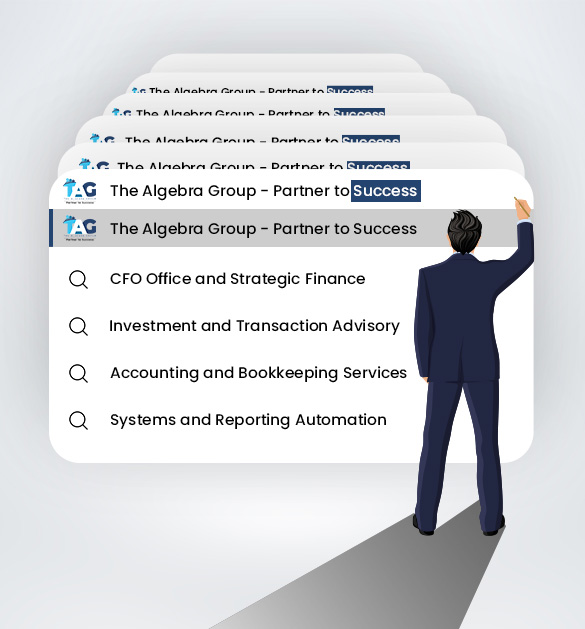

Fractional CFO, Investment &

M&A Advisory, Accounting and Automation Solutions

From CFO leadership to transactions, accounting, and automation, we operate as a seamless extension of your organization through our Team-as-a-Service (TaaS) model.

Bridge bandwidth constraints, capability gaps, and scalability challenges through our flexible, on-demand Team-as-a-Service (TaaS) finance model, delivering 4× leverage across time, talent, and execution

At The Algebra Group (TAG), our Team-as-a-Service (TaaS) finance model is what sets us apart. Through a flexible, on-demand approach, we provide a subscription-based access to a ready team of finance specialists across FP&A, reporting, transactions, and automation, maximising time, execution capacity, and depth of the right talent as your business scales, without the complexity of in-house hiring.

Driving Business Success with Modern Finance

Numbers That Tell OurGrowth and Impact Story

Our Global Client

Footprint

CEO

Varun, Founder & CEO of The Algebra Group, shares insights on modern finance, strategic thinking, and building scalable businesses.

TAG

Stay updated with The Algebra Group’s perspectives on smart finance, operational excellence, and everything that drives business performance and growth.

Your Hub for Strategic Finance Insights

What Our Clients Say

Informed Decisions Start Here

TaaS is our flexible, on-demand talent model where TAG becomes an extension of your in-house team. You get access to skilled finance, accounting, and analytics professionals without the overhead of hiring full-time staff, scaling up or down as your business needs evolve.

TAG delivers proven finance solutions through an embedded finance team, covering CFO Office & Strategic Finance, Investment & Transaction Advisory, Accounting & Bookkeeping, and Systems & Reporting Automation – all tailored to function like an in-house team.

TAG offers two flexible engagement models to suit client needs. For specific, time-bound requirements, clients can engage us on an ad-hoc basis and access expertise as needed. For continuous strategic support and long-term guidance, our retainer model ensures consistent involvement and deeper alignment with your business goals.

Businesses can get started with TAG by reaching out through our website to schedule an initial conversation. We assess your needs, understand your goals, and recommend a tailored engagement model aligned with your growth stage.

The Algebra Group (TAG) serves clients across key global markets including India, the United States, Canada, the United Kingdom, the United Arab Emirates, Singapore, and Australia. We support businesses across geographies through integrated finance, accounting, advisory, and automation capabilities.